Welcome to Silicon Sands News, read across all 50 states in the US and 96 countries.

We are excited to present our latest editions on how responsible investment shapes AI's future, emphasizing the OECD AI Principles. We're not just investing in companies, we're investing in a vision where AI technologies are developed and deployed responsibly and ethically, benefiting all of humanity.

Our mission goes beyond mere profit—we're committed to changing the world through ethical innovation and strategic investments.

We're delving into a topic reshaping the landscape of technology and investment: the role of governments in building thriving ecosystems for innovation

TL;DR

Governments play a crucial role in fostering innovation beyond traditional sovereign wealth funds. By employing diverse models such as fund-of-funds investing, government venture capital funds, tax incentives, public-private partnerships, and more, they support startups that push the boundaries in fields like artificial intelligence (AI). These investments drive economic growth and job creation while addressing critical healthcare, sustainability, and education societal challenges. For founders, executives, and investors, understanding these government initiatives reveals new pathways for funding and collaboration. For governments that have yet to embrace such strategies, there is an urgent need to invest in AI startups to remain competitive in the digital age. By building vibrant ecosystems where startups and venture capital mutually reinforce each other's successes, governments can catalyze a self-sustaining cycle of growth and innovation that benefits society.

How Governments Invest.

Role in fostering ecosystems, especially in transformative fields like artificial intelligence (AI). While sovereign wealth funds often grab headlines, they represent just one piece of the global investment puzzle. Globally, governments have devised diverse models to support startups, particularly those pushing the boundaries in AI.

These investments serve multiple purposes. They drive economic growth, create jobs, and position nations as global leaders in innovation. Simultaneously, they address societal challenges—healthcare, sustainability, and education—by funding startups developing groundbreaking AI solutions. For founders, executives, and investors, understanding these models reveals pathways to funding and collaboration. For governments that have yet to embrace these initiatives fully, the urgency is apparent—investing in AI startups is essential to remain competitive in the digital age.

Innovation doesn't happen in isolation—it is the lifeblood of economic growth and societal advancement. It requires a carefully nurtured ecosystem where visionaries can access resources and capital to turn bold ideas into reality.

AI is at the leading edge of innovation and transformative technologies, reshaping industries and redefining the boundaries of what's possible. However, transforming a groundbreaking idea into a market-ready solution is complex and often requires more than private capital and an entrepreneurial spirit. It necessitates a supportive ecosystem where visionaries can access resources and expertise that often require government support.

While sovereign wealth funds frequently capture headlines with substantial investments, they represent just one facet of governmental involvement in fostering innovation. Globally, governments are employing diverse models to support startups, especially those pushing the frontiers of AI. These models range from fund-of-fund investments and venture capital initiatives to accelerators, tax incentives, and public-private partnerships.

This exploration explores governments' role in nurturing AI innovation beyond traditional investment vehicles. We examine how different governmental strategies drive economic growth and job creation and address critical societal challenges. By investing in AI startups and encouraging venture capital, governments can position their nations as global leaders in innovation while ensuring that advancements align with public interests.

Understanding these models is essential for founders, executives, and investors seeking pathways to funding and collaboration. It is equally crucial for policymakers aiming to keep their nations competitive in the rapidly evolving digital landscape. By fostering environments where startups and venture capital mutually reinforce each other's success, governments can catalyze a self-sustaining cycle of growth and innovation.

In the following sections, we will look at various global models of government investment in AI startups, from fund-of-fund programs to direct investment initiatives to other ways governments support and encourage the required ecosystems. Through examples and case studies, we will highlight the impact of these investments on the AI ecosystem and discuss the challenges and considerations. Ultimately, this discussion underscores the collective responsibility of all stakeholders—governments, investors, corporations, and innovators—to collaborate in unlocking AI's potential for the betterment of society.

The Need for Government Involvement

Innovation does not happen in isolation. It requires a supportive ecosystem where visionaries can access the necessary resources, expertise, and capital to turn bold ideas into reality. While private investment is crucial, government involvement is essential to bridge the gaps the private sector may overlook, especially in high-risk, capital-intensive fields like AI.

This section explores the vital role of government participation in fostering AI innovation. We examine the strategic importance of fund-of-funds investing, a model where governments invest in venture capital funds instead of directly in startups. This approach enables governments to leverage the expertise of experienced fund managers, diversify investments to reduce risks and stimulate dynamic startup ecosystems by attracting additional private capital.

We also examine how building a robust innovation ecosystem requires a synergistic relationship between governments, startups, and venture capital firms. Governments can attract startups and investors by offering financial incentives, developing infrastructure, streamlining regulations, and cultivating a skilled workforce. Through examples of successful government initiatives worldwide, we illustrate how such strategies have catalyzed growth, particularly in the AI sector.

Understanding these models is crucial for founders, executives, investors, and policymakers. For founders, they reveal pathways to funding and collaboration that can accelerate their ventures. For governments, it underscores the urgency of investing in AI startups to remain competitive in the digital age and address pressing societal challenges. By fostering ecosystems where startups and venture capital mutually reinforce each other's success, governments can set the stage for a self-sustaining cycle of growth and innovation.

The Importance of Fund-of-Funds Investing

Fund-of-fund investing is a strategic approach in which governments invest in venture capital funds rather than directly in startups. This model enables them to leverage expertise, diversify investments, and stimulate ecosystems. By utilizing the specialized knowledge and networks of experienced fund managers, especially in the age of AI, governments can enhance the effectiveness of their investments. Access to this expertise is vital for navigating the complex landscape of startup funding, particularly in sectors like AI, where technical understanding is critical.

Diversifying investments across multiple funds allows governments to spread risks among startups and sectors. This risk mitigation is crucial in high-risk areas like AI, where technological and market uncertainties are significant. It reduces the impact of any single investment failure, contributing to a more stable investment portfolio. Government commitments often act as catalysts, attracting additional private investors to these funds. This crowding-in effect increases the total capital available for startups, enhancing the vibrancy and resilience of the startup ecosystem. Governments promote broader economic growth and innovation by supporting the venture capital industry.

Why Fund-of-Funds Investing Matters

Fund-of-fund investing amplifies the impact of public funds by indirectly supporting an increase in startups across various sectors and stages. This broader support fosters innovation and contributes to national economic development. Government investments instill confidence in private investors, encouraging them to commit resources to the country or region. This collaboration enhances the overall funding environment for startups and leads to significant advancements in technology and innovation.

By investing in various funds, governments reduce the reliance on the success of any single entity. This approach is especially beneficial in the AI sector, where rapid changes and uncertainties are common. Supporting domestic venture capital funds helps develop local fund management skills and knowledge. This strengthens the country's financial infrastructure and promotes sustainable economic growth by fostering a knowledgeable and experienced investment community.

Building a Vibrant Ecosystem

Government initiatives are pivotal in attracting startups and venture capital to countries and regions. By creating a favorable environment through supportive policies, funding opportunities, and infrastructure development, governments can position their regions as attractive destinations for innovative entrepreneurs and investors. This synergy is essential for fostering a dynamic and sustainable innovation ecosystem.

Startups are engines of innovation, bringing fresh ideas and disruptive technologies to the market. Transforming these ideas into viable businesses requires substantial financial resources from venture capital firms, strategic guidance, and industry connections. Conversely, venture capital firms depend on a steady pipeline of promising startups to generate investment returns. This interdependence creates a cycle where the presence of one attracts and sustains the other.

Governments enhance their appeal to startups and venture capital firms by offering financial incentives such as grants, tax breaks, and subsidies that reduce the initial costs of setting up a business or investing. For AI startups, which often face significant upfront expenses for research, development, and talent acquisition, such incentives can be decisive in choosing a location. Government initiatives signal a commitment to innovation and entrepreneurship, attracting venture capital firms seeking promising opportunities in vibrant and supportive markets.

Governments that invest in research institutions, technology parks, and incubators provide the necessary support systems for startups to thrive. These ecosystems facilitate collaboration between academia, industry, and investors, enhancing startups’ overall quality and potential. Venture capitalists are more likely to invest in regions where startups can access cutting-edge resources and expertise.

Governments that provide clear, transparent, and supportive regulations for business operations, intellectual property rights, and capital flows create an environment conducive to investment. Simplifying procedures for company registration, tax compliance, and cross-border transactions reduces barriers and encourages venture capital firms to enter the market. Streamlining regulatory processes also enhances a region's appeal to startups, allowing them to concentrate more on innovation and less on bureaucratic hurdles.

Governments develop a skilled workforce through universities and training programs, ensuring startups can access the human capital necessary for growth. This is especially important in the AI sector, where specialized expertise is crucial. A vibrant talent pool attracts startups and venture capital firms looking to capitalize on cutting-edge developments.

Examples of successful government efforts include Singapore, which has positioned itself as a leading hub for innovation and investment in Southeast Asia through initiatives like the Technopreneurship Investment Fund and co-investment schemes. The government offers financial incentives, invests in infrastructure, and provides a supportive regulatory environment, attracting startups and venture capital.

Israel, known as the "Startup Nation," has fostered a thriving tech ecosystem. In the 1990s, programs like the Project Yozma initiative offered tax incentives to foreign venture capital investments in Israel. These programs matched funding to venture capital firms investing in Israeli startups, attracting significant foreign investment and establishing a symbiotic relationship between startups and venture capital.

The United Arab Emirates has implemented initiatives like Dubai's free zones, which provide foreign-owned startups with tax exemptions, full ownership rights, and profit repatriation. These incentives have made the UAE a hotspot for startups and attracted significant venture capital investment, fostering a dynamic innovation ecosystem.

Canada's government has also made significant efforts. The Startup Visa Program offers permanent residency to immigrant entrepreneurs who can secure funding from designated Canadian investors. With programs like the Venture Capital Action Plan, which invests in private sector-led funds, Canada has attracted startups globally and mobilized billions in new venture capital.

Attracting startups and venture capital is increasingly critical in AI due to the high costs and risks of developing advanced technologies. Governments that successfully attract AI startups and venture capital can accelerate advancements in AI, leading to rapid technological progress, economic competitiveness, and societal benefits such as healthcare, education, and environmental sustainability improvements.

By fostering an ecosystem where startups and venture capital mutually reinforce each other's presence and success, governments set the stage for a self-sustaining cycle of growth and innovation. This holistic approach ensures that the ecosystem remains dynamic and resilient, capable of adapting to new challenges and opportunities in the ever-evolving global economy.

Examples of Fund-of-Funds Programs

The European Investment Fund (EIF), part of the European Investment Bank Group, manages fund-of-funds programs that invest in European venture capital funds. These investments focus on strategic sectors, including AI and deep tech. The EIF addresses market gaps and fosters innovation throughout Europe by providing capital to funds that support early-stage startups.

In Saudi Arabia, the Saudi Venture Capital Company (SVC) is a government investment arm that invests in private VC funds. By adopting a fund-of-funds strategy, SVC has supported over 30 funds. This approach has catalyzed growth in the Saudi startup ecosystem and attracted international investors, significantly enhancing the country's economic diversification efforts.

Australia's Venture Capital Programs, such as the Innovation Investment Fund (IIF) and subsequent initiatives, have utilized a fund-of-funds approach to stimulate early-stage venture capital. These programs have been instrumental in developing Australia's venture capital market and have supported numerous tech startups, contributing to the country's reputation as a hub for innovation.

Impact on the AI Ecosystem

Fund-of-fund investing significantly benefits the AI ecosystem. It grants access to specialized funds. AI startups often require investors who possess a deep understanding of complex technologies and the specific market dynamics of the AI industry. By investing in specialized AI funds, fund-of-fund ensures that these startups receive the necessary capital and strategic guidance from investors who comprehend the intricacies of the AI landscape.

This investment approach encourages innovation by indirectly promoting funding for innovative but high-risk AI ventures that might be overlooked. By increasing the capital pool available to venture funds, governments enable startups to pursue groundbreaking projects with the potential to drive significant technological advancements. This influx of funding empowers startups to take on ambitious endeavors that could lead to substantial progress in AI technology.

Lastly, fund-of-funds offer a global reach by investing in domestic and international funds. This strategy provides local AI startups access to global networks, markets, and best practices. International exposure is crucial for scaling AI solutions, competing worldwide and higher valuations. By connecting startups to a broader ecosystem, fund-of-funds facilitate the sharing of knowledge and resources essential for success in the highly competitive and rapidly evolving field of AI.

Global Models of Government Investment in Startups

Governments worldwide are adopting innovative strategies to invest in startups that drive innovation and economic growth. Recognizing that startups are vital engines of innovation, governments are moving beyond traditional funding mechanisms to embrace diverse models tailored to their unique priorities and economic contexts. These models provide critical financial support and offer strategic resources and infrastructure that enable startups to thrive in a competitive global market.

This section explores various global approaches to government investment in startups, particularly those pushing the boundaries in AI. Each model presents unique advantages for startups and investors, from government venture capital funds and public sector accelerators to tax incentives, public-private partnerships, and loan programs. By examining these strategies and their successful implementations—from France's Bpifrance and Singapore's SEEDS Capital to Israel's Innovation Authority and Germany's High-Tech Gründerfonds—we gain insights into how governments effectively foster vibrant innovation ecosystems.

Understanding these models is essential for founders seeking new funding avenues, investors looking for collaborative opportunities, and policymakers aiming to enhance their nation's competitive edge in the digital age. By leveraging these investment strategies, governments can directly influence the direction of innovation, address critical societal challenges, and ensure that their countries remain at the forefront of technological progress.

Government Venture Capital Funds

Government venture capital (GVC) funds provide direct equity investments in startups, focusing on high-growth sectors like AI. These funds de-risk private investments by taking on early-stage opportunities that might otherwise struggle to attract capital.

In France, Bpifrance has nurtured the country's tech ecosystem. Offering direct investments and co-investment opportunities with private venture capitalists ensures startups have the necessary growth resources. Similarly, South Korea's Korea Development Bank (KDB), through its KDB Capital division, provides venture financing to startups across multiple industries, including AI. Singapore's SEEDS Capital, managed by Enterprise Singapore, co-invests with private VCs to focus on sectors with high potential, such as artificial intelligence and deep tech.

These funds enable AI startups to tackle long R&D cycles and capital-intensive development processes. By providing early-stage funding, they ensure that promising technologies have the runway they need to succeed.

Public Sector Accelerators and Incubators

Public sector accelerators and incubators go beyond funding by offering mentorship, resources, and a collaborative environment for startups. They are particularly effective in fostering innovation by bridging the gap between academia, industry, and government. Innovate UK runs accelerator programs under the Catapult Network in the United Kingdom, targeting sectors like advanced manufacturing and digital technologies. These programs combine funding with strategic guidance to help AI startups navigate technical, regulatory, and market challenges and accelerate their journey to scale.

Tax Incentives and Grants

Tax incentives and grants are widely used tools to lower financial barriers for startups. By reducing operational costs or providing direct funding, governments encourage startups to pursue ambitious projects that might otherwise be deemed too risky.

Israel's Innovation Authority exemplifies this approach by offering grants and incentives to startups developing cutting-edge AI solutions. Australia's R&D Tax Incentive offsets eligible research and development expenses, giving AI startups the financial flexibility to innovate.

These initiatives are valuable for AI startups, which require significant upfront investments in data acquisition, algorithm development, and computational infrastructure. By relieving financial burdens, governments enable startups to focus on innovation rather than fundraising.

Public-Private Partnerships (PPPs)

Public-private partnerships align government resources with private sector expertise to drive innovation. These partnerships provide funding and create opportunities for startups to collaborate with established corporations.

Germany's High-Tech Gründerfonds (HTGF) operates as a public-private partnership, co-investing with private VCs in early-stage tech startups. The fund has managed over €2 billion and financed over 750 startups, facilitating follow-up financing rounds totaling about €6 billion from private funds. Japan’s Innovation Network Corporation fosters similar collaborations, focusing on advancing AI and deep tech through co-investment and mentorship.

PPPs create scalable solutions by balancing the efficiency of the private sector with the long-term vision of the public interest, making them a powerful model for AI startups.

Direct Investment Programs

Direct investment programs allow governments to support industries that strategically align with national priorities. Development banks or specialized agencies typically manage these programs.

Canada’s Business Development Bank (BDC) has been a cornerstone of the country’s innovation ecosystem, providing capital and advisory services to AI startups. The BDC offers financing and supports companies through growth and transition phases. In India, the Startup India initiative supports entrepreneurs through funding and a host of resources, fostering innovation across sectors. This includes tax exemptions, simplified regulations, and easier access to capital.

These programs enable governments to directly influence the direction of innovation directly, ensuring that critical challenges—such as ethical AI and sustainability—are addressed.

Loan Programs

Loan programs provide startups with non-dilutive funding options, allowing them to access capital while retaining equity. These loans are often backed by government guarantees, reducing lenders’ risks.

The Netherlands' Dutch Good Growth Fund (DGGF) offers favorable financing terms to support startups expanding into emerging markets. In Brazil, BNDES provides loans to AI startups developing transformative technologies, ensuring they have the resources needed to scale.

For founders, these programs offer an attractive alternative to equity financing, particularly when preserving ownership is a priority. They also open doors to international expansion, as some loan programs are designed to support cross-border activities.

Regional Development Funds

Regional development funds aim to stimulate innovation and economic growth in specific areas by creating localized hubs of activity. These hubs often feature collaboration between startups, universities, and established corporations.

The European Union's European Regional Development Fund (ERDF) supports innovation clusters across member states, including AI-focused initiatives. With around €226 billion for 2021-2027, the ERDF significantly reduces regional disparities and promotes sustainable development. In the United States, state-level programs like California’s economic development funds provide grants to startups in key sectors, including AI.

These funds foster environments where startups can thrive. By clustering talent and resources, they contribute to regional economic development. They also encourage knowledge sharing and collaboration, which are vital for innovation in AI.

Challenge Grants and Competitions

Challenge grants and competitions incentivize startups to tackle specific societal issues, aligning innovation with the public good.

The Dubai Future Accelerators program provides grants to startups addressing challenges with AI and future technologies. It focuses on transportation, health, and infrastructure, encouraging startups to develop solutions with significant societal impact. In Kenya, the ICT Innovation Drive funds startups that leverage AI to solve pressing social problems, such as access to healthcare and education.

These initiatives fund innovation and elevate startups' visibility, creating opportunities for collaboration and investment. They often lead to public-private partnerships that can accelerate the implementation of solutions.

Innovation Grants

Innovation grants, such as the U.S. Small Business Innovation Research (SBIR) program, are great tools to fuel the growth of startups tackling high-risk, high-reward challenges. The SBIR program awards competitive grants to small businesses pursuing innovative projects with significant potential for commercialization and societal impact. Focused on industries like AI, healthcare, and energy, SBIR supports early-stage research and development, enabling startups to refine prototypes and validate breakthrough technologies. These grants, typically offered in phased funding rounds, provide non-dilutive capital, allowing startups to retain equity while pursuing ambitious goals. Innovation grants empower startups to push boundaries, drive economic growth, and address critical global challenges by fostering collaboration with federal agencies and creating pathways for technological advancements.

Challenges and Considerations

While government investment in AI startups offers significant opportunities for technological advancement and economic growth, it also presents various challenges that need careful consideration. These challenges include the risk of exacerbating economic inequalities if the benefits of AI investments are concentrated among a select few. Governments must ensure their funding models promote inclusive growth by supporting startups from diverse backgrounds and regions.

Ethical concerns also arise with government-backed AI initiatives, particularly regarding potential algorithm biases that could reinforce societal inequalities. Ethical guidelines and rigorous oversight are essential to ensure that AI systems are fair and do not perpetuate gender, racial, or other biases.

The rapid pace of technological innovation in AI often outpaces existing regulatory frameworks, creating legal and policy challenges. Governments need to develop adaptive regulations that protect public interests without stifling innovation. These regulations should include updating data privacy laws and setting standards for AI safety.

Investing in AI technologies is inherently risky because predicting which technologies will succeed is difficult. Governments should balance their investment portfolios to mitigate potential losses and diversify across various AI subfields to spread risk.

Meaningful investment in AI requires substantial financial resources. Prioritizing these investments over other needs can be politically challenging. Transparent decision-making processes and demonstrating the long-term benefits of AI investments can justify allocating resources. Governments must recognize and address these challenges to ensure that their investments in AI startups lead to equitable, ethical, and sustainable innovation.

The Role of Venture Capital

Limited Partners (LPs) provide the capital that fuels venture funds. Their willingness to invest in funds that align with responsible and sustainable AI practices can shape the industry's trajectory. By supporting funds and prioritizing ethical considerations, LPs ensure their investments contribute to a positive societal impact.

Opportunity for LPs: Co-investment programs allow LPs to invest alongside government funds in promising startups, and institutional co-investment platforms enable direct investment alongside venture capital funds.

Venture Capitalists (VCs) are gatekeepers of innovation. They can select and nurture startups that align with responsible AI principles. By collaborating with government programs, VCs can leverage additional resources and de-risk investments in cutting-edge technologies.

Collaboration Example: Matching funds requirements in government programs creates opportunities for VCs to partner with government initiatives, amplifying the impact of investments.

Executives from established corporations can drive innovation by partnering with startups. Their industry expertise and resources can accelerate the development and deployment of AI solutions. Through corporate venture arms or direct collaborations, they can amplify the impact of government and VC investments.

Corporate Engagement: Many Fortune 500 companies have established innovation labs or venture arms that invest in AI startups, often in partnership with government initiatives.

Governments and policymakers foster innovation through funding, regulations, and incentives. By adopting models that support AI startups, they can address societal challenges and stimulate economic growth. Policymakers must ensure that rules balance innovation with ethical considerations, fostering an environment where responsible AI can thrive.

Policy Recommendations:

Establish Co-Investment Programs: Attract private venture capital by sharing investment risks.

Implement Supportive Policies: Tax incentives, regulatory reforms, and subsidies make the investment environment more attractive.

Invest in Innovation Infrastructure: Support entrepreneurship through education, research facilities, and innovation hubs.

Let's Wrap This Up

Innovation thrives when founders have access to supportive ecosystems needed to turn bold ideas into reality. Governments worldwide recognize the importance of investing in AI startups through various models beyond sovereign wealth funds. By leveraging strategies such as fund-of-fund investing, offering financial incentives, developing infrastructure, and fostering public-private partnerships, governments can directly influence the direction of innovation. These efforts position nations as global leaders in technology and ensure that advancements align with public interests while addressing pressing societal challenges.

Understanding and engaging with government initiatives can unlock new funding and collaboration opportunities for founders and investors, accelerating the journey from concept to market-ready solutions. Policymakers are responsible for creating environments where responsible AI can thrive by balancing innovation with ethical considerations and fostering ecosystems where startups and venture capitalists support each other. Governments can set the stage for sustainable economic growth and technological progress.

At 1Infinity Ventures, we are committed to nurturing a responsible AI ecosystem by connecting startups with strategic funding opportunities and promoting collaboration among all stakeholders: governments, investors, corporations, and innovators. Together, we can unlock AI's full potential, drive sustainable growth, and address the pressing challenges of our time. Innovation is a collective journey, and by working collaboratively, we can shape a future where technology serves the betterment of society.

Resources

Global Government Fund-of-Fund Programs

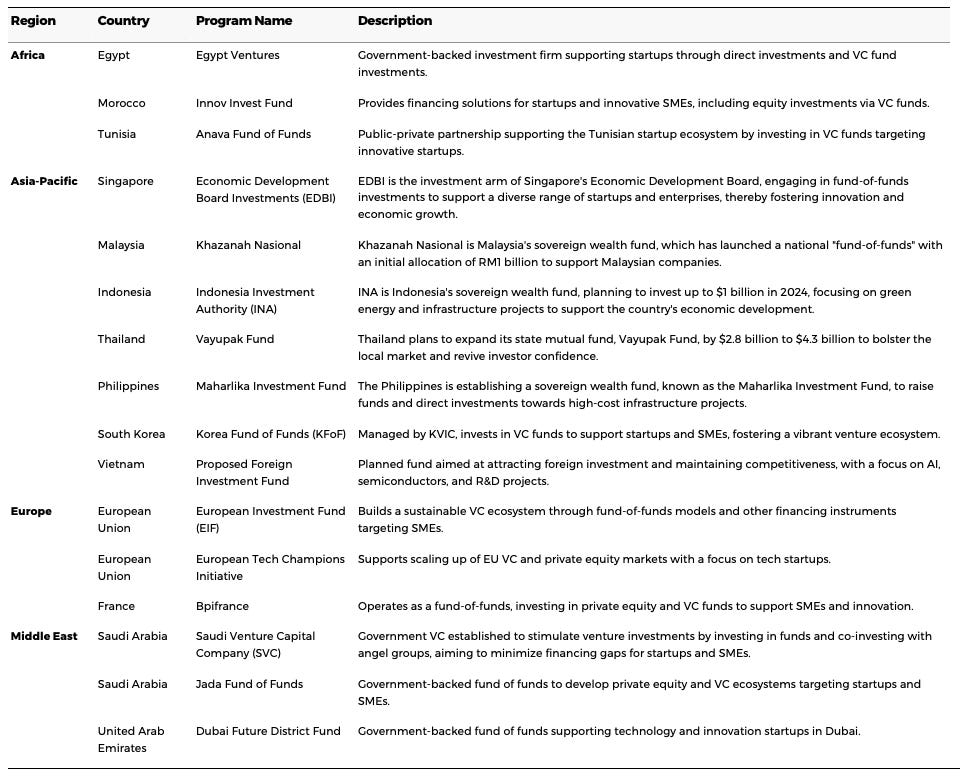

Africa

Egypt

Program Name: Egypt Ventures

Description: Government-backed investment firm supporting startups through direct and VC fund investments.

Link: Egypt Ventures

Morocco

Program Name: Innov Invest Fund

Description: Provides financing solutions for startups and innovative SMEs, including equity investments via VC funds.

Link: Innov Invest Fund

Tunisia

Program Name: Anava Fund of Funds

Description: Public-private partnership supporting the Tunisian startup ecosystem by investing in VC funds targeting innovative startups.

Link: Anava Fund

Asia-Pacific

Singapore

Program Name: Economic Development Board Investments (EDBI)

Description: Investment arm of Singapore's Economic Development Board, engaging in fund-of-fund investments to support a diverse range of startups and enterprises, fostering innovation and economic growth.

Link: EDBI

Malaysia

Program Name: Khazanah Nasional

Description: Malaysia's sovereign wealth fund has launched a national fund-of-fund with an initial allocation of RM1 billion to support Malaysian companies.

Link: Khazanah Nasional

Indonesia

Program Name: Indonesia Investment Authority (INA)

Description: Indonesia's sovereign wealth fund plans to invest up to $1 billion in 2024, focusing on green energy and infrastructure projects to support economic development.

Link: INA

Thailand

Program Name: Vayupak Fund

Description: Thailand plans to expand its state mutual fund by $2.8 billion to bolster the local market and revive investor confidence.

Link: Vayupak Fund

Philippines

Program Name: Maharlika Investment Fund

Description: Establishing a sovereign wealth fund to raise funds and direct investments toward high-cost infrastructure projects.

South Korea

Program Name: Korea Fund of Funds (KFoF)

Description: Managed by KVIC, invests in VC funds to support startups and SMEs, fostering a vibrant venture ecosystem.

Link: KVIC

Vietnam

Program Name: Proposed Foreign Investment Fund

Description: Planned fund to attract foreign investment and maintain competitiveness, focusing on AI, semiconductors, and R&D projects.

Link: Reuters Article

Europe

European Union

Program Name: European Investment Fund (EIF)

Description: Builds a sustainable VC ecosystem through fund-of-funds models and other financing instruments targeting SMEs.

Link: EIF

Program Name: European Tech Champions Initiative

Description: Supports scaling up of EU VC and private equity markets, focusing on tech startups.

Link: ETCI

France

Program Name: Bpifrance

Description: Operates as a fund-of-fund, investing in private equity and VC funds to support SMEs and innovation.

Link: Bpifrance

Middle East

Saudi Arabia

Program Name: Saudi Venture Capital Company (SVC)

Description: Government VC was established to stimulate venture investments by investing in funds and co-investing with angel groups, aiming to minimize financing gaps for startups and SMEs.

Link: SVC

Program Name: Jada Fund of Funds

Description: Government-backed fund of funds to develop private equity and VC ecosystems targeting startups and SMEs.

Link: Jada

United Arab Emirates

Program Name: Dubai Future District Fund

Description: Government-backed fund of funds supporting technology and innovation startups in Dubai.

Link: DFDF

Global Government Direct Investment Programs

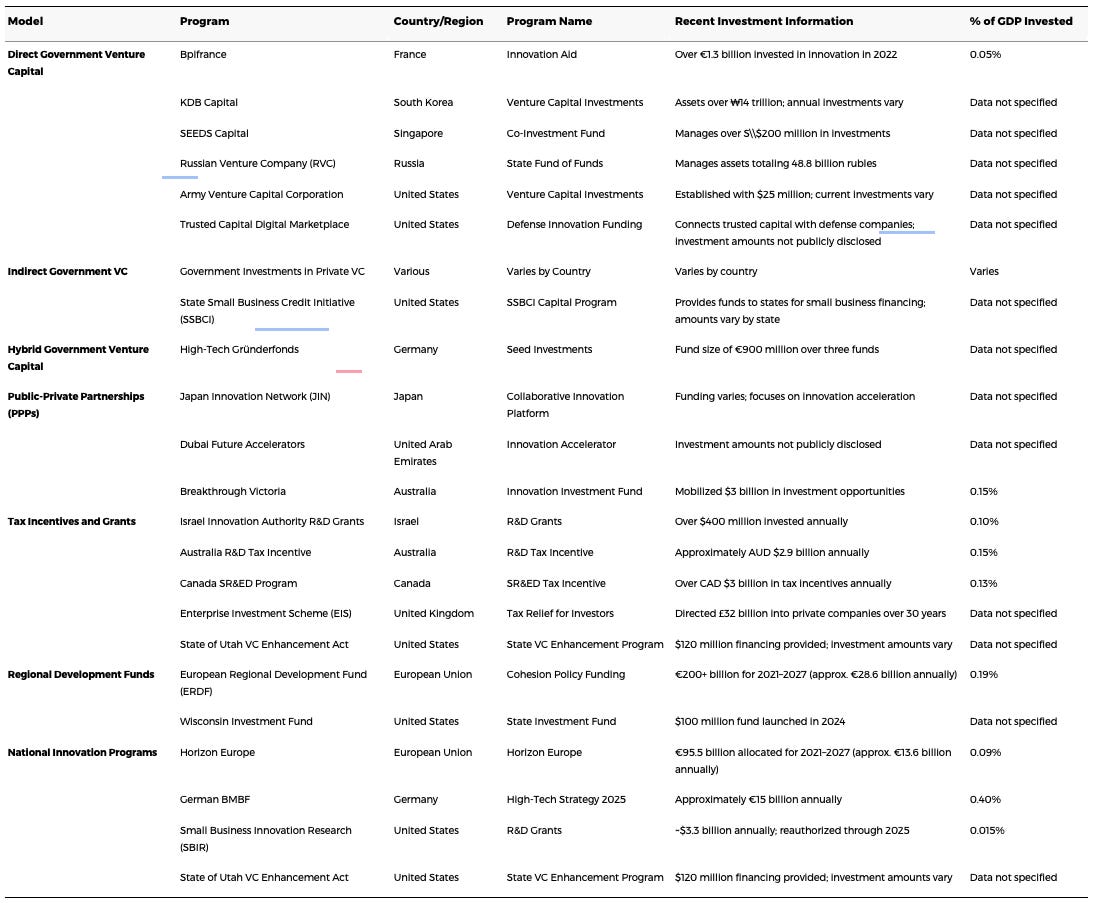

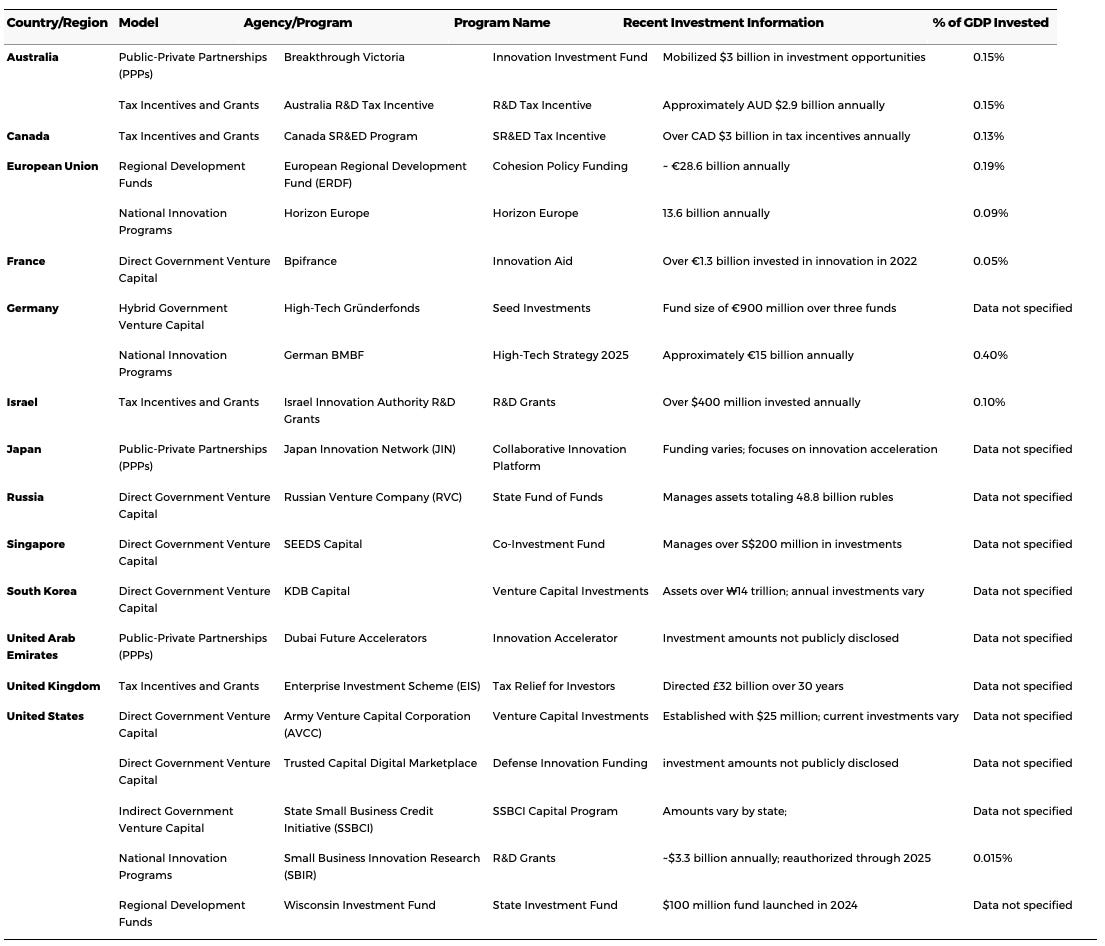

Government Venture Capital

Bpifrance (France)

Program Name: Innovation Aid

Program Website: Bpifrance

KDB Capital (South Korea)

Program Name: Venture Capital Investments

Program Website: KDB Capital

SEEDS Capital (Singapore)

Program Name: Co-Investment Fund

Program Website: SEEDS Capital

Russian Venture Company (RVC) (Russia)

Program Name: State Fund of Funds

Program Website: RVC

Army Venture Capital Corporation (AVCC) (United States)

Program Name: Venture Capital Investments

Program Website: AVCC

Trusted Capital Digital Marketplace (United States)

Program Name: Defense Innovation Funding

Program Website: Trusted Capital

Indirect Government Venture Capital

State Small Business Credit Initiative (SSBCI) (United States)

Program Name: SSBCI Capital Program

Program Website: SSBCI

Hybrid Government Venture Capital

High-Tech Gründerfonds (HTGF) (Germany)

Program Name: Seed Investments

Program Website: HTGF

Public-Private Partnerships (PPPs)

Japan Innovation Network (JIN) (Japan)

Program Name: Collaborative Innovation Platform

Program Website: JIN

Dubai Future Accelerators (United Arab Emirates)

Program Name: Innovation Accelerator

Program Website: Dubai Future Accelerators

Breakthrough Victoria (Australia)

Program Name: Innovation Investment Fund

Program Website: Breakthrough Victoria

Tax Incentives and Grants

Israel Innovation Authority R&D Grants (Israel)

Program Name: R&D Grants

Program Website: Israel Innovation Authority

Australia R&D Tax Incentive (Australia)

Program Name: R&D Tax Incentive

Program Website: R&D Tax Incentive

Canada SR&ED Program (Canada)

Program Name: SR&ED Tax Incentive

Program Website: SR&ED Program

Enterprise Investment Scheme (EIS) (United Kingdom)

Program Name: Tax Relief for Investors

Program Website: EIS

Wisconsin Investment Fund (United States)

Program Name: State Investment Fund

Program Website: Wisconsin Investment Fund

Regional Development Funds

European Regional Development Fund (ERDF) (European Union)

Program Name: Cohesion Policy Funding

Program Website: ERDF

National Innovation Programs

Horizon Europe (European Union)

Program Name: Horizon Europe

Program Website: Horizon Europe

German BMBF (Germany)

Program Name: High-Tech Strategy 2025

Program Website: BMBF

Small Business Innovation Research (SBIR) (United States)

Program Name: R&D Grants

Program Website: SBIR

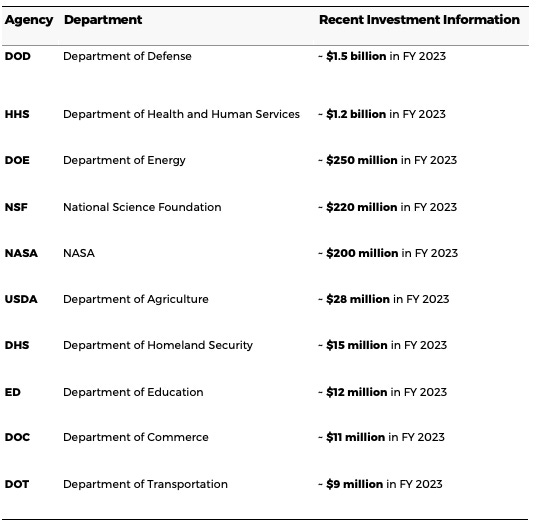

United States SBIR Programs:

Department of Defense (DOD)

SBIR Program Website: DOD SBIR/STTR Program

Recent Investment Information: Over $1.5 billion awarded in SBIR/STTR grants in FY 2023

Department of Health and Human Services (HHS)

SBIR Program Website: NIH SBIR/STTR Program

Recent Investment Information: Over $1.2 billion awarded in FY 2023

Department of Energy (DOE)

SBIR Program Website: DOE SBIR/STTR Programs

Recent Investment Information: Approximately $250 million awarded in FY 2023

National Science Foundation (NSF)

SBIR Program Website: NSF SBIR/STTR Program

Recent Investment Information: Approximately $220 million awarded in FY 2023

National Aeronautics and Space Administration (NASA)

SBIR Program Website: NASA SBIR/STTR Program

Recent Investment Information: Approximately $200 million awarded in FY 2023

Department of Agriculture (USDA)

SBIR Program Website: USDA SBIR Program

Recent Investment Information: Approximately $28 million awarded in FY 2023

Department of Homeland Security (DHS)

SBIR Program Website: DHS SBIR Program

Recent Investment Information: Approximately $15 million awarded in FY 2023

Department of Education (ED)

SBIR Program Website: ED SBIR Program

Recent Investment Information: Approximately $12 million awarded in FY 2023

Department of Commerce (DOC)

SBIR Program Website: NOAA SBIR Program

Recent Investment Information: Approximately $11 million awarded in FY 2023

Department of Transportation (DOT)

SBIR Program Website: DOT SBIR Program

Recent Investment Information: Approximately $9 million awarded in FY 2023

Environmental Protection Agency (EPA)

SBIR Program Website: EPA SBIR Program

Recent Investment Information: Approximately $5 million awarded in FY 2023

RECENT PODCASTS:

🔊 AI and the Future of Work published November 4, 2024

🔊 Humain Podcast published September 19, 2024

🔊 Geeks Of The Valley. published September 15, 2024

🔊 HC Group published September 11, 2024

🔊 American Banker published September 10, 2024

UPCOMING EVENTS:

The AI Summit New York, NY 11-12 Dec ‘24

DGIQ + AIGov Washington, D.C. 9-13 Dec ‘24

NASA Washington D.C. 25 Jan ‘25

Metro Connect USA 2025 Fort Lauderdale FL 24-26 Feb ‘25

2025: Milan, Hong Kong

NEWS AND REPORTS

WIRED Middle East Op-ED published August 13, 2024

AI Governance Interview: with Andraz Reich Pogladic published October 17, 2024

INVITE DR. DOBRIN TO SPEAK AT YOUR EVENT.

Elevate your next conference or corporate retreat with a customized keynote on the practical applications of AI. Request here

Unsubscribe

It took me a while to find a convenient way to link it up, but here's how to get to the unsubscribe. https://siliconsandstudio.substack.com/account